Michigan Gambling Tax

Michigan is one of the most rapidly expanding gambling markets in the US. It allows online gambling and sports betting, which gives players more opportunities for big wins. However, you are eligible to pay taxes no matter whether you gamble online or at land-based casinos.

So, let’s get into more details that will help you get a better understanding of the tax on Michigan gambling winnings.

Does Michigan Tax Gambling Winnings?

All types of gambling wins are taxable in Michigan. More precisely, for any amount you win, the casino, sportsbook, or pari-mutuel provider might withhold taxes and provide a W-2G form to you. However, even if the provider didn’t withhold the taxes automatically and you didn’t receive any form, you still have an obligation to report all of your legal online gambling Michigan income.

All types of gambling wins are taxable in Michigan. More precisely, for any amount you win, the casino, sportsbook, or pari-mutuel provider might withhold taxes and provide a W-2G form to you. However, even if the provider didn’t withhold the taxes automatically and you didn’t receive any form, you still have an obligation to report all of your legal online gambling Michigan income.

The most crucial part is that this rule applies to all types of gambling in MI, including poker games, sports betting MI, and various casino apps. In addition, the Internal Revenue Service is also involved when you earn a win, so you must know how taxes apply to your gambling wins, how to claim them, and understand the Michigan gambling tax deduction.

Michigan Tax Law Gambling: Do You Pay Tax on Gambling Promotions?

Michigan proposed a gambling tax even for gambling promotions because many gamblers begin their journey due to the welcome bonuses that are pretty intriguing. More precisely, each promotion is taxable as income on both your federal and state tax return, no matter whether you receive a payment in cash, extra spins, or bonus bets.

Michigan proposed a gambling tax even for gambling promotions because many gamblers begin their journey due to the welcome bonuses that are pretty intriguing. More precisely, each promotion is taxable as income on both your federal and state tax return, no matter whether you receive a payment in cash, extra spins, or bonus bets.

Players often back off of casino promotions because of the Michigan gambling tax, forgetting that they still come with great value. For example, welcome bonuses can add thousands of dollars to your win. Also, there are regular promotions that you can use daily, weekly, or monthly, decreasing your overall gambling costs.

Michigan Tax Rate on Gambling Winnings

As you’re now aware that you’re responsible for paying taxes to the state of MI and the IRS, let’s explain how much of your wins you need to provide.

As you’re now aware that you’re responsible for paying taxes to the state of MI and the IRS, let’s explain how much of your wins you need to provide.

Regarding IRS, you will need to pay 25% of your wins, no matter how much you earn. So, for example, if you win $20, you need to pay one-quarter of that amount.

When it comes to the government, they tax you far less. The Michigan gambling tax laws require you to pay an additional 4.25% to the government of your total win. In any case, you can’t just leave the casino without reporting the money.

Moreover, for wins up to $5,000, the casino doesn’t withhold any taxes, and you should provide personal information like your name and social number so they can inform the appropriate authorities. If you refuse to provide this information, you will get a penalty of 3%.

How to Claim and Report Michigan Gambling Winnings Tax?

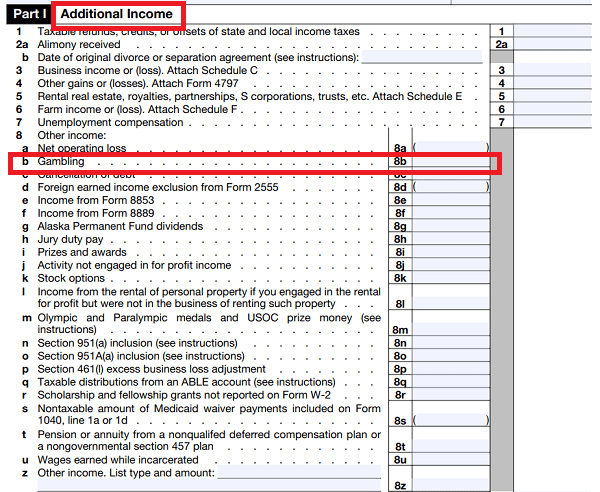

Reporting your gambling wins for taxation is a must, even if you gamble at Michigan online casinos. Therefore, you’ll first need to fill out the IRS Schedule 1. This is a form for extra income and adjustments to your primary income. Then, you need to report where your wins came from in Line 8 in Part 1 of the form. Finally, you should give information about the casino and the date of your gambling wins.

Reporting your gambling wins for taxation is a must, even if you gamble at Michigan online casinos. Therefore, you’ll first need to fill out the IRS Schedule 1. This is a form for extra income and adjustments to your primary income. Then, you need to report where your wins came from in Line 8 in Part 1 of the form. Finally, you should give information about the casino and the date of your gambling wins.

After filling out the Schedule 1 document, you need to proceed with the total to Line 7a of your regular tax return, which will add your wins to your overall taxable income.

Also, you can list any Michigan gambling loss tax deduction on your Schedule 1. The deductions can include student loan interest payments or business expenses. These deductions are beneficial for reducing your taxable income.

Handling Tax on Gambling Winnings in Michigan If You Don’t Receive W-2G

As we explained, if you receive over $5,000, casinos don’t automatically withhold taxes. Therefore, you won’t receive a W-2G form. However, there is still a way for you to settle the gambling tax Michigan requires.

As we explained, if you receive over $5,000, casinos don’t automatically withhold taxes. Therefore, you won’t receive a W-2G form. However, there is still a way for you to settle the gambling tax Michigan requires.

You should keep a record or some kind of a diary of all your gambling activities, as the IRS can ask you to hand out evidence of your wins and losses so that they can collect the Michigan gambling winnings tax rate.

In addition, if you placed online bets, your casino, sportsbook, or pari-mutuel provider will probably have a detailed history of your bets from the last year, which you can easily access and provide to the IRS.

Michigan Income Tax Gambling Losses

Michigan tax on gambling winnings provides a solution for deducting your losses. However, you should keep a few things in mind:

Michigan tax on gambling winnings provides a solution for deducting your losses. However, you should keep a few things in mind:

- You can deduct gambling losses only if you itemize them first on your tax return. However, most players don’t do this, so they’re not eligible for deducting their gambling losses.

- Your gambling losses can’t exceed your winning within that year. So, for example, if you won $6,000 but lost $12,000, you can only deduct up to $6,000.

- You must have the required documentation that the IRS might ask for. This includes W-2G forms, betting tickets with accurate dates and locations, financial or bank statements, canceled checks or credit records, and Form 5754 for group wins.

Does Michigan Tax Gambling Winnings from Lottery?

As well as all gambling wins, Michigan lottery wins are also taxable. Here are the key things you need to remember:

As well as all gambling wins, Michigan lottery wins are also taxable. Here are the key things you need to remember:

- Prizes of $600 and less are not part of the tax withholdings by the Michigan lottery.

- If players earn more than $600, they will receive a W-2G form.

- Michigan lottery doesn’t withhold taxes on prizes between $601 and $5,000. Therefore, players must report the winnings to the IRS and the Michigan Department of Treasury.

- All wins of $5,000 are automatically withheld and charged with the same Michigan gambling tax percentage of 4.15% state tax and 24% IRS tax.

- Michigan lottery states that these withholding may not settle the players’ full tax fee.

- All players of the Michigan lottery are liable for taxation, no matter whether they are or not MI residents.

Does Michigan Tax Group Gambling Winnings?

Even if you’re part of a group gambling win, you must still pay taxes. In such a case, you should fill out Form 5754 so that IRS gets a report of your winnings. However, things are slightly different as one person in the group identifies as the primary winner, while others determine the prize they claim.

Even if you’re part of a group gambling win, you must still pay taxes. In such a case, you should fill out Form 5754 so that IRS gets a report of your winnings. However, things are slightly different as one person in the group identifies as the primary winner, while others determine the prize they claim.

This process is a bit more complex, as the casino where you won may still ask for a copy so they can fulfill their gambling records.

Michigan Gambling Tax Laws Regarding Multi-State Lottery Wins

As you might get it until now – Michigan taxes you for every gambling win. Therefore, if you win a multi-state lottery like Mega Millions or Powerball, the taxes are calculated in your income. More precisely, you pay 24% to IRS and 4.25% to the state of MI. This taxation remains the same for both lump sums and 30-year annuities.

As you might get it until now – Michigan taxes you for every gambling win. Therefore, if you win a multi-state lottery like Mega Millions or Powerball, the taxes are calculated in your income. More precisely, you pay 24% to IRS and 4.25% to the state of MI. This taxation remains the same for both lump sums and 30-year annuities.

Michigan Gambling Tax – What Happens if You Don’t Report It?

Anyone who doesn’t want to report their gambling wins becomes subject to a 3% penalty. In addition, IRS knows your gambling wins due to the W-2G form you receive, so if you refuse to report them, it will impose interest fees and penalties.

Anyone who doesn’t want to report their gambling wins becomes subject to a 3% penalty. In addition, IRS knows your gambling wins due to the W-2G form you receive, so if you refuse to report them, it will impose interest fees and penalties.

However, you’re not free from paying taxes if your gambling wins don’t meet the 2-2G threshold. So, it’s better if you don’t hide your wins.

FAQ

- ✔️ Do I Really Have to Report Everything?

- Yes, you have to. Michigan gambling tax laws have covered each part of the gambling system, so you are required to pay taxes for poker games, online gambling, and land-based gambling. You should even pay the Michigan sports gambling tax.

- ✔️ Am I Guaranteed to be Audited if I don’t Report Something?

- Yes, you are guaranteed to be audited. The IRS has control over tax payments due to the W-2G form, but even if you don’t meet the W-2G threshold, you should keep a diary or any kind of record of your gambling wins, as the IRS may ask for them at any time.

- ✔️ Are Lottery Winnings Taxable?

- Yes, they are. Like any other gambling form, lottery wins are also part of the Michigan tax gambling laws. Also, lottery wins receive the same gambling tax rate as any other wins. More precisely, the government gets 4.25% while the IRS gets 24% of your total gambling win.

- ✔️ Are Sports Betting Taxable?

- Yes, it is. Sports betting is still relatively new in Michigan, but that doesn’t mean it’s excluded from the taxing laws. So everyone who likes sports betting must be aware that they will pay the Michigan sports gambling tax.

- ✔️ Is Online Sports Betting, Casino Gambling, and Poker Taxable?

- Yes, they are. All of these online gambling types are taxable in the state of Michigan. These online casino activities are much harder to conceal than regular land-based gambling, so there isn’t a way that you can avoid paying taxes for them.

- ✔️ Do I Have to Pay Taxes if I Don’t Live in Michigan?

- Yes, you have. Even if you’re not a Michigan resident, you still have to pay gambling taxes. The process consists of filling out a form for nonresidents and reporting your wins to your home state. However, if you live in one of the six neighboring states (Indiana, Ohio, Illinois, Wisconsin, Kentucky, and Minnesota), you don’t need to fill out the nonresident form as they have reciprocal agreements with Michigan.